The world of cryptocurrency is replacing the way we perceive finances with the introduction of digital assets that can exist and run without currency exchange in the usual system of banks. Market Capitalization of Cryptocurrency though remains one of the leading criteria used to measure the value and relative significance of cryptocurrencies in the market.

What is Market Capitalization?

Market capitalization, or market cap – is the total value of a cryptocurrency being in question. It is the amount that gets derived after the multiplication of the present value of one single unit of the cryptocurrency by the total number of coins or tokens. This benchmark gives an investor and analyst an understanding of the size, liquidity, and direct proportion of each cryptocurrency to the rest of the markets.

How is Market Capitalization Calculated?

The formula for calculating market capitalization is straightforward:

Market Capitalization = Current Price per Unit x Total Circulating Supply

For example, a cryptocurrency whose current price is $100 and total supply is 10 million coins will have an asset’s market cap of $1 billion.

Significance of Market Capitalization

Market capitalization is a statistic indicator of the value of a particular cryptocurrency for traders and investors. Additionally, it gives information on the popularity and size of cryptocurrencies. Below are the vital things to take note of for this market cap:

Comparison

Market capitalization serves to as a tool to evaluate the value of one cryptocurrency to another. Established cryptocurrencies with substantial market capitalizations are commonly regarded as more established and widely embedded in the market.

Investment Potential

The market value of the coin is the main indicator that the investors use to define whether this particular cryptocurrency is promising enough or not. Market capitalization concentration may imply greater stability and higher liquidity, which, in turn, will attract investors who are looking for long-term expansion with good profits.

Volatility Management

On the other hand, volatility risk can be controlled by investors (in the stock market crucially through market capitalization). Generally, cryptocurrencies with a large total market value do not appear to be as volatile as lower-cap coins. There is some stability found in such currencies even during the time of market fluctuations.

Factors Affecting Market Capitalization

Not least of those is the market capitalization of a certain crypto coin.

Price Fluctuations

The price changes of a cryptocurrency involve its total market capitalization being directly affected. The markets go up due to the rising trend of bullish prices, while the bearish trends that are going down are the resulted as a consequence of a decrement in market capitalization of cryptocurrency.

Circulating Supply

The number of coins or tokens existing in circulation varies greatly because it is a key factor in evaluating market capitalization. Projects that have limited supply, and more so, when the circulating supply is low, will go through a market capitalization hike as a result of the scarcity principle.

Market Sentiment

Market sentiment, change in market trend, promotion of new regulations. As well as introduction of new technology are all the factors that are driving the price of the cryptocurrencies.

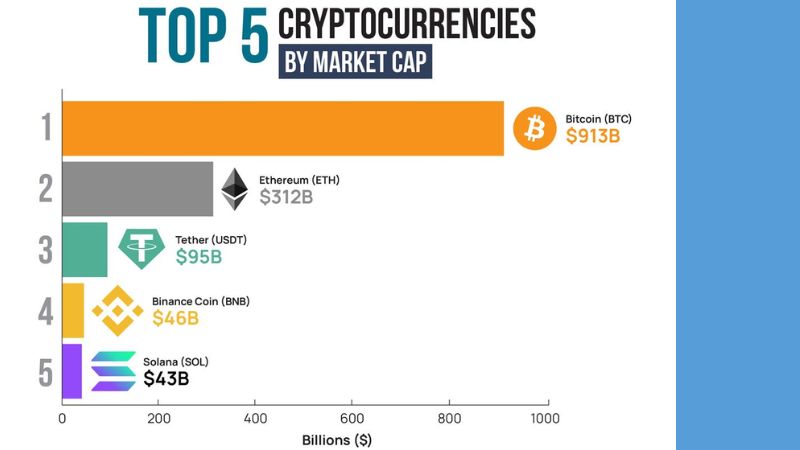

Market Capitalization Rankings

Cryptocurrencies tend to have differentiated ratings that are designated through their market capitalizations. Sites, platforms, and portals connected to cryptocurrency market tracing, for example, CoinMarketCap and CoinGecko, supply immediate information regarding the market capitalizations, hence investors can track the shifts and trends within the market.

Conclusion

Market capitalization is a primary tool for evaluating the significance, influence, and value of cryptocurrencies in the world financial markets. Through mastering the basics of market capitalization of cryptocurrency and everything that it is made of, investors can use this knowledge to make proper investment decisions taking the investors’ liquidity, stability, and growth prospects into account.